Blog

Rick Reeder

The kids are back at school, and that first bracing cold front of fall has hit Austin! Okay, the second part isn't true at all... but there HAS been an event that might spur you to reach out for a coffee: the Federal Reserve Bank cut core interest rates by .5% this month. A reduction was anticipated, but most analysts were surprised by the size of this one. You have probably seen a news story or 5 about this, all claiming to communicate "what this means for you!".

Well, the devil is in the details, and a 75-second news story might give you some hints, but you should do some deeper analysis before jumping into action. For example, if you bought a home last year with an 8% mortgage, should you refinance now, or wait? Well, it depends. You've been waiting to sell your home and downsize - is now the time? It depends.

These are decisions with major financial impact to your life, so it's best to consult with an expert. If you're thinking of buying, selling, refinancing, or any combination of the three - hit me up! I'd love to buy you a coffee and discuss your UNIQUE situation. Coffee's on me and advice is free.

moreRick Reeder, Broker

This is a story about some clients of mine, written in part by ChatGPT! I wanted to dip my toe in the AI waters, and here is the result. "Printed" with my clients' permission.

John and Chelsea were a couple with a shared dream: to find a place they could call home, both in Austin, Texas, and Nairobi, Kenya. They were first-time homebuyers, navigating the daunting process with a mix of excitement and trepidation. Their unique situation required them to split their time between two continents, and they needed a home that could accommodate their nomadic lifestyle while also serving as a source of income through short-term rentals (STR).

Their search was filled with challenges, from finding a property that met their specific needs to handling the logistics of signing closing paperwork from thousands of miles away. That's where I came in. As their agent, I was determined to make their dream a reality.

After weeks of searching, we finally found the perfect home: a charming bungalow in East Austin with a beautiful backyard and a cozy feel, ideal for short-term rentals. It ticked all the boxes, but there was one hurdle left to overcome: closing the deal from Nairobi. As we delved into the closing process, we hit a roadblock. The lender required all paperwork to be signed at the U.S. Embassy in Nairobi to be considered valid, but the next available appointment was weeks after our scheduled closing date.

moreRick Reeder

If you've paid much attention to the news this past year, you know that 2023 was a rough one for the real estate industry, nation-wide. The Fed's aggressive rate hikes to fight inflation made buying a home almost twice as expensive (with traditional financing) as it was before they began raising rates. This left a lot of people on the sidelines. First time homebuyers were priced out of starter homes, and folks looking to move for work, convenience, or downsizing struggled with the reality of swapping their current 3% mortgage for one at 7% or even 8% at the peak last fall.

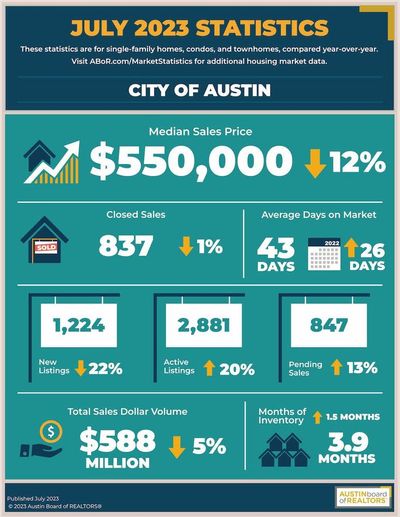

The natural response to this in an open market is for prices to fall, and fall they did. Even in Austin, which has been resilient even in tough times like 2008-2009, we saw the average sales price decline by 10% (see ABOR Market Statistics).

All this said, I do believe we are at an inflection point, and the market will start to shift back towards sellers. There is a lot of pent-up demand from folks who couldn't or wouldn't move last year, and rates have come down from peaks and are predicted to drop further in the second half of this year. I think this makes it a perfect time to buy! In real estate there is an old saying "Marry the home, but date the rate.", meaning that you can always refinance or potentially recast your loan later if rates do come down. I think prices are touching bottom, and will begin to come up in March. March-July should be a good time to list your home this year, too.

moreRR

First a personal update: being a full-time agent has been great! I am grateful that I had the opportunity to “retire” early from General Motors and get a nice separation package that gave me the confidence to try this out. That said, my first couple of months have been very successful! Since my last day at GM I’ve closed a lease for a client in Brushy Creek, sold 5 acres of unimproved land in Spicewood for my friend’s mother in law, and helped some other friends purchase their dream home in Highland Park West (my biggest deal to date!). Also, by this time next month, I should be a broker and I’m excited for what’s next!

Now, on to the current real estate market. I’m mainly speaking here about the Austin area, but many of these thoughts apply nationwide. For the city of Austin in July, the median sales price was $550,000, which is down 12% YoY. Days on Market was 43, which is up 26 days YoY. And, finally, Months of Inventory was 3.9 – up by more than 1.5 months. So, prices down and inventory up, resulting in longer days on market. Moving towards a buyers’ market, for sure. Traditional wisdom is that 6 months of inventory is “balanced” between buyers and sellers, and we aren’t there yet, but this is very different from 2021, when a seller held ALL of the cards.

moreRick Reeder

After a 30-year long career in IT, I've made the decision to make #realestate my full time job. I have been doing it on weekends and evenings, helping friends and family over the last 5 years, and I'm ready and I'm excited!

I'm planning to get my Broker's license this summer, which is kind of like a promotion in real estate. Brokers control and are responsible for transactions and agents. Agents represent the brokerage and their clients. As part of applying, I had to make a list of every closed transaction I've done, and I've logged 32 transactions worth nearly $16M over those 5 years, so Jimi's question: Yes. I'm experienced. I also currently work under Rose & Associates Properties, and my broker Sean has logged thousands of transactions over the last 20+ years, so if you work with me, you get him as a bonus. :-D

If you're curious what your home is worth, or you're looking for an investment/vacation home, or just want to catch up, please hit me up! Thanks for following - and I always have time for you and your referrals - that's the highest compliment!

moreRick Reeder

The Austin real estate market has been crazy since Covid hit in spring of 2020. First, everything went deathly still... then slowly momentum started to build on the buy-side, making it an extreme sellers' market for about 2 years. There was very limited supply (builders struggled with supply chain, permitting, etc) and extraordinary demand (150 people/day moving to the area, PLUS investors got wind of the appreciation and cash flow potential in central Texas). Roughly one in four SFH bought in Austin was purchased by an investor of some sort.

More recently we've seen a fairly significant swing in the other direction. A ton of new supply (mostly new construction and folks trying to time the peak) has come on the market, and demand dipped (higher interest rates and general economic uncertainty to blame here). Now we are seeing more and more price drops - in June closed prices were lower than original list price for the first time in a LONG time. Where we had been seeing less than two weeks of inventory, we now have more than two months' worth.

Now, all that said, six-months' worth of inventory is considered a "balanced market", where neither the buyer nor seller has a systemic advantage. So, we are still in what is considered a sellers' market... but, I think buyers have a unique and somewhat limited opportunity for the next 8-9 months, or so. Let me tell you why.

moreRick Reeder

Short Term Rentals, or STRs, are a very hot investment space right now. Revenue numbers can dwarf long-term rental units, if your property is in a desirable location with a strong tourism component. Yes, there are higher costs as well (property management, cleaning, etc), but in a market like Austin, the numbers are very compelling. STR is the best way to maximize your revenue.

However, investors who are familiar with Austin know that the city has made it difficult and expensive to own and operate STRs here. Restrictions include that only owner-occupied dwellings are eligible, and one must apply-for and keep current a license to operate a STR. However, by working with an experienced agent (like me) you can identify work-arounds. For example, if you have a minimum rental period of 30 days, you're not considered an STR. These rentals are very sought-after in Austin right now, and people are moving here, but want a couple of months to get the lay of the land before buying... but most apartments and SFH rentals require 12 month leases. A great niche!

Another option would be to look at suburbs or nearby recreational areas like Lake LBJ.

Curious to know more? Click this link to get in touch!

moreRick Reeder

What if I told you there was a way to buy a lake house (or other vacation property), and get someone else to pay for it? Seems crazy, I know, but I've done it. Twice. Let me tell you my story...

First of all, like a lot of people, I've always wished for a lake house near Austin. I've done well in my career, but not to the point that I could plunk down 20% on a decent place *and* afford two mortgages. But in 2019 I stopped wishing and asked myself how I could make it happen.

To make a long story short, my strategy involved two key things:

(1) Partnering with friends whom I enjoy hanging out with, who also have kids around my daughter's age. This cut my down payment obligation down from 20% to 5% and does the same thing for operational expenses.

(2) Putting the property into the short-term-rental pool for much of the year. Generating rental income has allowed us to not put a nickel towards paying our mortgage, insurance, etc. Our best month to date was this past July with over $21,000 in gross rent!

You can take a look at the property here. We use a property management company, so we don't get those calls when the toilet breaks and we don't deal directly with guests. We have built up a good amount of cash in reserve now, and we could update the home or take it out of the rental pool and absorb the hit to revenue if we choose to.

moreRick Reeder

I'm sure everyone has heard the news over the last 6 months that the Austin real estate market (and many others around the country) has been extraordinarily hot.

Stories of sellers getting 50 offers on the day they list, and stories of buyers having to offer $100,000 over asking with appraisal and inspection waived are fading into (recent) history.

It is still a sellers' market, though.

Roughly two weeks of inventory in Austin proper, and about 3 weeks in the MSA. For reference, a "balanced market" carries about 6 months of inventory. I say all of this to indicate that if you've been thinking of selling - now may be the perfect time.

The overall market has risen by 40% year-over-year, it is still very much a sellers market, and if you price accurately, you can still count on multiple offers and getting under contract within a few days.

If you've been thinking of selling and would like me to tell you what your home is worth, click the "Get in Touch" tab.

Or just want to chat? I'd be happy to buy you a coffee and meet up!

RR

moreRick Reeder

I can't tell you how many times I have had this conversation in the past few months with my friends and neighbors here in Austin: 'Man, I would love to sell my house right now, but... where would I go?". It's true! This is a fantastic time to sell - competition is fierce and you can get top dollar and amazing terms. Let me share some ideas with you all, and perhaps we can chat some more if any of these resonate with you.

Move on up: We have some friends who have wanted to move to a larger house with room for a pool for a few years. They finally felt they were ready financially, but they were worried about the problem I just mentioned: they could get top dollar, but how could they compete for a new larger home? Putting in a contingent offer certainly wouldn't be competitive with cash. Here is what they did: listed their current home with a fairly aggressive (low) price. Buyers flocked and within a day they had an offer for cash, 10% over list, appraisal waiver and lease-back for free until September. Now they have cash in the bank and 4 months to shop for a new home!

Move on out: There is an old saying in real estate for first time home buyers: drive until you qualify. In other words, the farther from the city center you are, the cheaper real estate gets. That's generally true in Austin, too. If you're relatively central and you're like a lot of people who have experienced working from home during the pandemic, you may dream of a home with two offices or a pool. This dream could be a reality for you if you are willing to trade your current location for more comfortable living arrangements. If you are someone who won't be commuting to work every day any longer, it may make sense for you to head farther out into suburbia to get your dream house!

moreRick Reeder

As the parents of a young daughter, my wife and I started thinking about college expenses before she was out of the womb. We have a 529 set up, and we put money in every month. We're trying to be smart about saving for college, and I hope that any of who you read this are being smart, too.

Having said that, I am still learning! I have known a couple of people who bought homes to house their college-bound children, and it seemed a smart move. After doing some digging, I can say it is a *very* smart move!

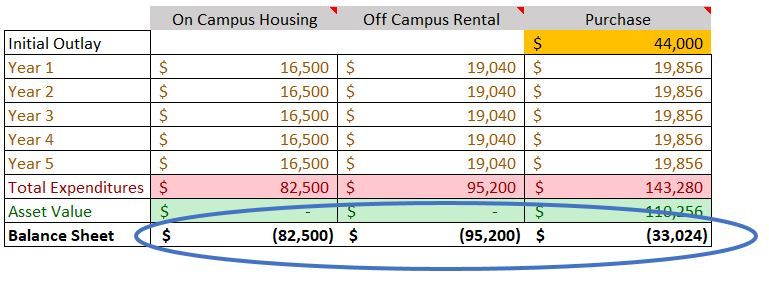

Consider this scenario... There are a lot of assumptions in here, and I can certainly walk you through them if you are curious, just email me. I compared on-campus housing through UT Austin, off-campus housing near UT Austin, and buying a condo near UT Austin. As you can see, there is a considerable difference when you have a salable asset at the end of 5 years, compared to simply writing a check to a landlord.

Now consider that you can legally utilize 529 funds to charge your child rent - up to the university says a room costs - while they are in school. See this article for more, and of course consult a tax adviser for your individual situation.

moreRick Reeder

There are few good things about this Global Pandemic - I'm definitely OVER IT. However, if you have a mortgage, the last few months have been the best time in history to refinance. All my mortgage broker friends have been SWAMPED (and I know some great ones - hit me up!). But Fannie & Freddie will start charging 0.5% for Refis on September 1st - see this Axios Article for why. However, if you're buying a home, the extra fee won't apply, so these historically low rates still apply to you if you're moving!

Another, possible, long-term benefit of Covid-19 may be the move towards remote work for many information workers. This opens up a world of possibilities for those who can work from anywhere. If you could live anywhere, perhaps a larger home (with TWO home offices??) would be nice? A pool? Bigger lot, lower taxes, better weather? What would make you move, and could you save big money doing it? Maybe so - hit me up if you'd like to look at your options.

I'm always here if you or a friend/family member wants to talk about real estate!

moreRick Reeder

First of all, let me say that these are frightening times. There is a global pandemic that has sickened millions of people, killed hundreds of thousands, destroyed millions of jobs in the USA and the effects will echo around the world for years and years. I'm praying for everyone affected. We are in a recession, officially, in the USA, and with stock market volatility, interest rate confusion and even news of oil prices going negative - all leaves us shocked and confused.

The impact of all of this for Austin real estate, so far at least, has been fairly straightforward: new listings have slowed substantially and some were pulled. However, there are still folks who are looking to buy. When demand is fairly steady, but supply suddenly dips- the result is that prices are rising and "days-on-market" are going down.

If you've been thinking of listing, this is a unique time - especially in the $500K-$2M price range. If you're shopping for investment properties in the less-than $500K price range, my feeling is that prices won't be dropping for a few more months. If you have questions about buying or selling- contact me and let's walk through it together.

******

Check out (and share!) my new video!

moreRick Reeder

If you're like most people, you've had dreams of owning a vacation getaway. Maybe a lake house? Something at the coast, or a condo near a ski resort? For most people it is out of reach because of the large upfront cost, and of course, ongoing payments with a traditional mortgage. Here are some strategies that can bring the dream closer to reality!

One approach is to buy a property and place it on a short-term rental site like VRBO or AirBNB when you're not using it. You need to ensure that there aren't any barriers to this via local law, HOA or Condo Associations. This brings in revenue to help offset costs like debt service, taxes, maintenance, etc. Of course, this has challenges if you're remote - cleaning after guests leave, damage, etc. I recommend using a property manager to assist with these tasks, but of course, that adds a cost.

Another approach, to use in conjunction with the first, is to partner up! If you have some friends who have a dream similar to yours, you can purchase a property together, splitting the upfront costs as well as ongoing ones. For this to be successful, you'll want to create an operating agreement up front, so everyone is on the same page about when each party will have access to the property, when it will be available for rent, who will manage the property, and what to do when unexpected costs come up. The time for this is *before* you ink a deal! You should also consider an exit strategy up front. Do all parties want to keep the property indefinitely and pass it to your estates? Do you want to have it while the kids are growing up and look at selling at a certain future date? Having the right Realtor, lender and property manager will be key to your success!

moreRick Reeder

Check out this story from the Austin Business Journal. Austin expected by many economists to be the top performing real estate market of 2020. If you are interested in investing - it is not too late to grab some appreciation in this market. Additionally, if you are renting, this is a great time to consider buying. There are many loan programs that offer down payments as low as 5%. Reach out to me if you would like to get more information!

moreRick Reeder

Use a strategy I call "the ladder" for retirement income.

What if you could make five-figures (or more) per year, tax-free, in your retirement? It's possible using a strategy I call The Ladder. Here's how it works. Each year you purchase one rental property. Between now and your retirement, you have a tenant in your property that covers your mortgage and a reserve. Ideally you also have some cash flow, but for the purposes of this strategy, that isn't necessary. To illustrate, let's assume your properties average $250,000 in current value and you're 15 years away from retiring.

15 years from now, you're property should be worth $378,000, assuming 3% appreciation. If you put 20% ($50,000) down to acquire the property, you would owe approximately $138,000 on your initial 30 year mortgage. That gives you equity of $240,000. At this point, you could do a cash-out refinance at 80% Loan-to-Value, of $190,000. Assuming you include your $138,000 remaining loan balance, you can "withdraw" nearly $60,000 of equity in the form of a loan, which isn't taxed. Obviously, this includes a lot of assumptions, and you should check with your tax adviser for your individual situation.

moreRick Reeder

According to PWC, Austin is the #1 place for real estate investment in the USA. See this article for the details.One of the main reasons I got into real estate, other than enjoying helping my friends and family find their dream homes, is to eventually begin investing in real estate in Central Texas. My initial goal is to buy 4-5 rental homes that will cash flow a little bit now, mainly for reserves for repairs and improvements. I would like to have them on 15 year notes, which would have them paid-for when my wife and I are about 65 years old, and ready to retire. This should provide us with that "mailbox money" that everyone wants in their retirement years. We have our traditional 401k investments, and this would provide a third income stream to help us have a fun lifestyle in our retired years (social security, 401k and real estate). It will also provide a running business that our daughter can inherit when we're gone (or she can take over when she's ready and grow it!). If this sounds appealing to you, too, reach out and let's talk!

more

AUSTIN, TX– Strong home buying activity throughout the summer led to double-digit home sales growth in July, according to the July 2018 Central Texas Housing Market Report released today by the Austin Board of REALTORS®. The five-county Metropolitan Statistical Area (MSA) experienced the highest volume of home sales since July 2011, and the highest median home price on record for any month.

more

Why not use your child's college housing as an opportunity to invest in a very fast growing market. Now you need to decide where they will live while they are here. it can make a lot of sense to buy a property here instead of renting or using student housing. for example, you can build 4+ years of equity and capture any appreciation that occurs while your child is in school here. upon graduation, if they elect to stay, housing is already secured. if they move on, then you can decide to rent your property out to new tenants, potentially generating cash flow and continuing to capture appreciation and build equity. or, you can sell and harvest any appreciation and equity you've built. the average price of a single family home in Austin has gone from just under $250,000 in 2013 to just over $300,000 in November of 2018. if your child had been enrolled at UT Austin for those five years, you would (on average) have roughly $50,000 in appreciation! rick reeder has been in Texas for over 30 years, and has over a decade of experience working with international students, their families, and the University of Texas international student services office - through the non-profit he founded called the African Leadership Bridge. Let Mr. Reeder use his experience and knowledge of the market for your benefit.

more