Blog

Rick Reeder

The kids are back at school, and that first bracing cold front of fall has hit Austin! Okay, the second part isn't true at all... but there HAS been an event that might spur you to reach out for a coffee: the Federal Reserve Bank cut core interest rates by .5% this month. A reduction was anticipated, but most analysts were surprised by the size of this one. You have probably seen a news story or 5 about this, all claiming to communicate "what this means for you!".

Well, the devil is in the details, and a 75-second news story might give you some hints, but you should do some deeper analysis before jumping into action. For example, if you bought a home last year with an 8% mortgage, should you refinance now, or wait? Well, it depends. You've been waiting to sell your home and downsize - is now the time? It depends.

These are decisions with major financial impact to your life, so it's best to consult with an expert. If you're thinking of buying, selling, refinancing, or any combination of the three - hit me up! I'd love to buy you a coffee and discuss your UNIQUE situation. Coffee's on me and advice is free.

moreRick Reeder, Broker

This is a story about some clients of mine, written in part by ChatGPT! I wanted to dip my toe in the AI waters, and here is the result. "Printed" with my clients' permission.

John and Chelsea were a couple with a shared dream: to find a place they could call home, both in Austin, Texas, and Nairobi, Kenya. They were first-time homebuyers, navigating the daunting process with a mix of excitement and trepidation. Their unique situation required them to split their time between two continents, and they needed a home that could accommodate their nomadic lifestyle while also serving as a source of income through short-term rentals (STR).

Their search was filled with challenges, from finding a property that met their specific needs to handling the logistics of signing closing paperwork from thousands of miles away. That's where I came in. As their agent, I was determined to make their dream a reality.

After weeks of searching, we finally found the perfect home: a charming bungalow in East Austin with a beautiful backyard and a cozy feel, ideal for short-term rentals. It ticked all the boxes, but there was one hurdle left to overcome: closing the deal from Nairobi. As we delved into the closing process, we hit a roadblock. The lender required all paperwork to be signed at the U.S. Embassy in Nairobi to be considered valid, but the next available appointment was weeks after our scheduled closing date.

moreRick Reeder

If you've paid much attention to the news this past year, you know that 2023 was a rough one for the real estate industry, nation-wide. The Fed's aggressive rate hikes to fight inflation made buying a home almost twice as expensive (with traditional financing) as it was before they began raising rates. This left a lot of people on the sidelines. First time homebuyers were priced out of starter homes, and folks looking to move for work, convenience, or downsizing struggled with the reality of swapping their current 3% mortgage for one at 7% or even 8% at the peak last fall.

The natural response to this in an open market is for prices to fall, and fall they did. Even in Austin, which has been resilient even in tough times like 2008-2009, we saw the average sales price decline by 10% (see ABOR Market Statistics).

All this said, I do believe we are at an inflection point, and the market will start to shift back towards sellers. There is a lot of pent-up demand from folks who couldn't or wouldn't move last year, and rates have come down from peaks and are predicted to drop further in the second half of this year. I think this makes it a perfect time to buy! In real estate there is an old saying "Marry the home, but date the rate.", meaning that you can always refinance or potentially recast your loan later if rates do come down. I think prices are touching bottom, and will begin to come up in March. March-July should be a good time to list your home this year, too.

moreRR

First a personal update: being a full-time agent has been great! I am grateful that I had the opportunity to “retire” early from General Motors and get a nice separation package that gave me the confidence to try this out. That said, my first couple of months have been very successful! Since my last day at GM I’ve closed a lease for a client in Brushy Creek, sold 5 acres of unimproved land in Spicewood for my friend’s mother in law, and helped some other friends purchase their dream home in Highland Park West (my biggest deal to date!). Also, by this time next month, I should be a broker and I’m excited for what’s next!

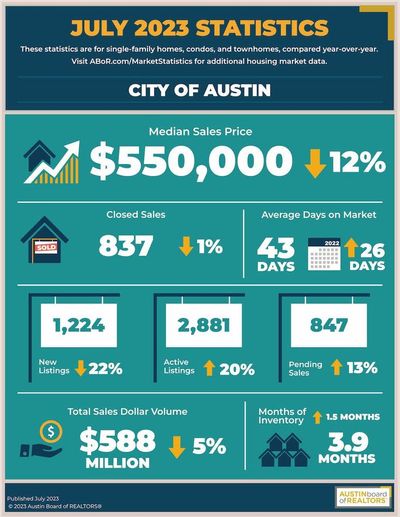

Now, on to the current real estate market. I’m mainly speaking here about the Austin area, but many of these thoughts apply nationwide. For the city of Austin in July, the median sales price was $550,000, which is down 12% YoY. Days on Market was 43, which is up 26 days YoY. And, finally, Months of Inventory was 3.9 – up by more than 1.5 months. So, prices down and inventory up, resulting in longer days on market. Moving towards a buyers’ market, for sure. Traditional wisdom is that 6 months of inventory is “balanced” between buyers and sellers, and we aren’t there yet, but this is very different from 2021, when a seller held ALL of the cards.

moreRick Reeder

After a 30-year long career in IT, I've made the decision to make #realestate my full time job. I have been doing it on weekends and evenings, helping friends and family over the last 5 years, and I'm ready and I'm excited!

I'm planning to get my Broker's license this summer, which is kind of like a promotion in real estate. Brokers control and are responsible for transactions and agents. Agents represent the brokerage and their clients. As part of applying, I had to make a list of every closed transaction I've done, and I've logged 32 transactions worth nearly $16M over those 5 years, so Jimi's question: Yes. I'm experienced. I also currently work under Rose & Associates Properties, and my broker Sean has logged thousands of transactions over the last 20+ years, so if you work with me, you get him as a bonus. :-D

If you're curious what your home is worth, or you're looking for an investment/vacation home, or just want to catch up, please hit me up! Thanks for following - and I always have time for you and your referrals - that's the highest compliment!

moreRick Reeder

The Austin real estate market has been crazy since Covid hit in spring of 2020. First, everything went deathly still... then slowly momentum started to build on the buy-side, making it an extreme sellers' market for about 2 years. There was very limited supply (builders struggled with supply chain, permitting, etc) and extraordinary demand (150 people/day moving to the area, PLUS investors got wind of the appreciation and cash flow potential in central Texas). Roughly one in four SFH bought in Austin was purchased by an investor of some sort.

More recently we've seen a fairly significant swing in the other direction. A ton of new supply (mostly new construction and folks trying to time the peak) has come on the market, and demand dipped (higher interest rates and general economic uncertainty to blame here). Now we are seeing more and more price drops - in June closed prices were lower than original list price for the first time in a LONG time. Where we had been seeing less than two weeks of inventory, we now have more than two months' worth.

Now, all that said, six-months' worth of inventory is considered a "balanced market", where neither the buyer nor seller has a systemic advantage. So, we are still in what is considered a sellers' market... but, I think buyers have a unique and somewhat limited opportunity for the next 8-9 months, or so. Let me tell you why.

moreRick Reeder

Short Term Rentals, or STRs, are a very hot investment space right now. Revenue numbers can dwarf long-term rental units, if your property is in a desirable location with a strong tourism component. Yes, there are higher costs as well (property management, cleaning, etc), but in a market like Austin, the numbers are very compelling. STR is the best way to maximize your revenue.

However, investors who are familiar with Austin know that the city has made it difficult and expensive to own and operate STRs here. Restrictions include that only owner-occupied dwellings are eligible, and one must apply-for and keep current a license to operate a STR. However, by working with an experienced agent (like me) you can identify work-arounds. For example, if you have a minimum rental period of 30 days, you're not considered an STR. These rentals are very sought-after in Austin right now, and people are moving here, but want a couple of months to get the lay of the land before buying... but most apartments and SFH rentals require 12 month leases. A great niche!

Another option would be to look at suburbs or nearby recreational areas like Lake LBJ.

Curious to know more? Click this link to get in touch!

moreRick Reeder

What if I told you there was a way to buy a lake house (or other vacation property), and get someone else to pay for it? Seems crazy, I know, but I've done it. Twice. Let me tell you my story...

First of all, like a lot of people, I've always wished for a lake house near Austin. I've done well in my career, but not to the point that I could plunk down 20% on a decent place *and* afford two mortgages. But in 2019 I stopped wishing and asked myself how I could make it happen.

To make a long story short, my strategy involved two key things:

(1) Partnering with friends whom I enjoy hanging out with, who also have kids around my daughter's age. This cut my down payment obligation down from 20% to 5% and does the same thing for operational expenses.

(2) Putting the property into the short-term-rental pool for much of the year. Generating rental income has allowed us to not put a nickel towards paying our mortgage, insurance, etc. Our best month to date was this past July with over $21,000 in gross rent!

You can take a look at the property here. We use a property management company, so we don't get those calls when the toilet breaks and we don't deal directly with guests. We have built up a good amount of cash in reserve now, and we could update the home or take it out of the rental pool and absorb the hit to revenue if we choose to.

moreRick Reeder

I'm sure everyone has heard the news over the last 6 months that the Austin real estate market (and many others around the country) has been extraordinarily hot.

Stories of sellers getting 50 offers on the day they list, and stories of buyers having to offer $100,000 over asking with appraisal and inspection waived are fading into (recent) history.

It is still a sellers' market, though.

Roughly two weeks of inventory in Austin proper, and about 3 weeks in the MSA. For reference, a "balanced market" carries about 6 months of inventory. I say all of this to indicate that if you've been thinking of selling - now may be the perfect time.

The overall market has risen by 40% year-over-year, it is still very much a sellers market, and if you price accurately, you can still count on multiple offers and getting under contract within a few days.

If you've been thinking of selling and would like me to tell you what your home is worth, click the "Get in Touch" tab.

Or just want to chat? I'd be happy to buy you a coffee and meet up!

RR

more