As the parents of a young daughter, my wife and I started thinking about college expenses before she was out of the womb. We have a 529 set up, and we put money in every month. We're trying to be smart about saving for college, and I hope that any of who you read this are being smart, too.

Having said that, I am still learning! I have known a couple of people who bought homes to house their college-bound children, and it seemed a smart move. After doing some digging, I can say it is a *very* smart move!

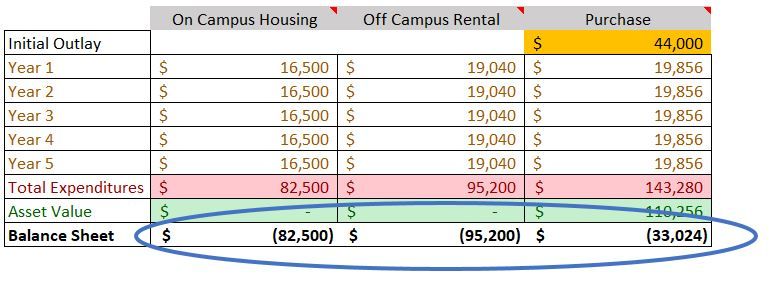

Consider this scenario... There are a lot of assumptions in here, and I can certainly walk you through them if you are curious, just email me. I compared on-campus housing through UT Austin, off-campus housing near UT Austin, and buying a condo near UT Austin. As you can see, there is a considerable difference when you have a salable asset at the end of 5 years, compared to simply writing a check to a landlord.

Now consider that you can legally utilize 529 funds to charge your child rent - up to the university says a room costs - while they are in school. See this article for more, and of course consult a tax adviser for your individual situation.

At the end of their college journey, you can keep your investment property and potentially have cash flow coming in, or you can harvest your appreciation, note reduction and reclaim your down payment. Power comes from having options. Contact me today if you'd like to discuss this further!

-RR