First a personal update: being a full-time agent has been great! I am grateful that I had the opportunity to “retire” early from General Motors and get a nice separation package that gave me the confidence to try this out. That said, my first couple of months have been very successful! Since my last day at GM I’ve closed a lease for a client in Brushy Creek, sold 5 acres of unimproved land in Spicewood for my friend’s mother in law, and helped some other friends purchase their dream home in Highland Park West (my biggest deal to date!). Also, by this time next month, I should be a broker and I’m excited for what’s next!

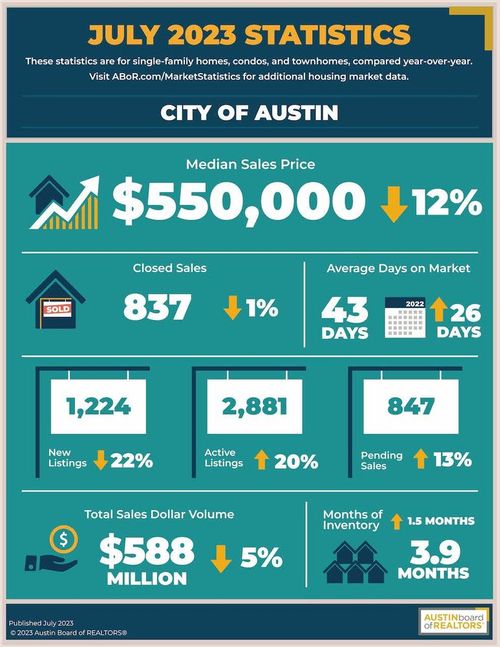

Now, on to the current real estate market. I’m mainly speaking here about the Austin area, but many of these thoughts apply nationwide. For the city of Austin in July, the median sales price was $550,000, which is down 12% YoY. Days on Market was 43, which is up 26 days YoY. And, finally, Months of Inventory was 3.9 – up by more than 1.5 months. So, prices down and inventory up, resulting in longer days on market. Moving towards a buyers’ market, for sure. Traditional wisdom is that 6 months of inventory is “balanced” between buyers and sellers, and we aren’t there yet, but this is very different from 2021, when a seller held ALL of the cards.

So, why are we moving in this direction? First and foremost, interest rates have gone up very significantly over the last two years as the Fed battles inflation. This makes the number of people who could afford to buy a home at, say, $550,000, shrink. In a fairly standard/traditional home purchase, the buyer puts 20% down and finances the rest. That mortgage payment with a 7% interest rate is $2,927. At 3% it would have been $1,855. Taxes and insurance excluded. So ceteris paribus (everything else equal) the rate change has driven monthly payments up by more than 50%! So, as a seller, you have fewer buyers in your potential audience and demand goes down. As a buyer your max budget is probably nearly cut in half.

This same dynamic impacts supply. As someone with a sub-3% mortgage, I can tell you that it would take something life-changing to make me move and take on a 7% mortgage. That means that my home’s not going on the market anytime soon, and there are a LOT of people like me and my wife. Most of the homes being bought and sold in the Austin MSA are new construction. This is because a large home builder has the resources and the motivation to offer incentives like paying points on a mortgage for a buyer, or lowering prices. They need to keep selling homes to keep the engine of their business running.

These are just a couple of factors impacting the housing market in Austin right now. There are others (people are still moving here, which helps stabilize prices, e.g.) and I don’t want this post getting much longer. So, what’s next for Austin housing? Looking into my crystal ball, my educated guess is that things will continue to be fairly slow compared to the heyday of the last decade. Once the Fed announces that they think they’ve beat inflation back and there is room for a potential rate drop, we will see prices stabilize and maybe come up a bit. But overall I think these slower times will last through 2024 and possibly beyond. Some folks say there is a big “reckoning” coming and that 2020-2021 were a bubble. I’m not currently in that camp, but time will tell.

As always, my friends, please reach out if you want to chat or get comps run on your home or neighborhood! And please remember that I am here if you need something to help grow your business or just want to talk.

-RR